The Withdrawal is in And the Wall Street Dealers are Raking in Trillions of Dollars. 2 Credit Cards for Every Man, Woman, and Child in the U.S.

- 0 Comments

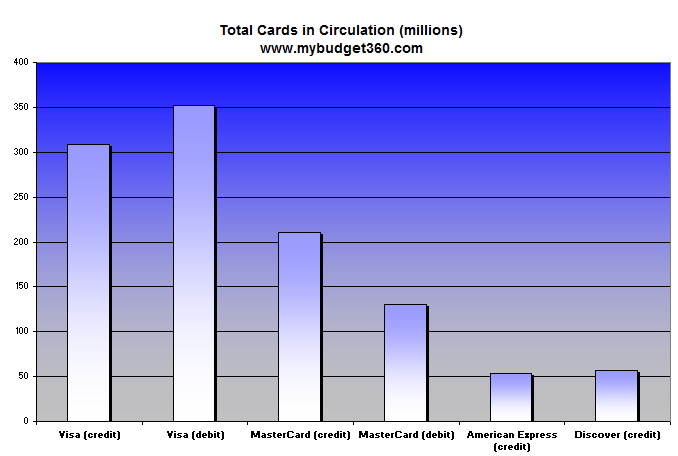

The credit card as we have it in the U.S. is really a unique phenomenon:

Source: Creditcards.com

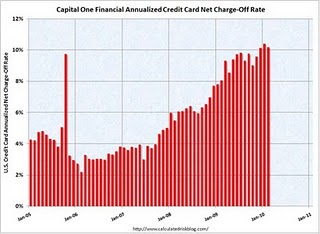

Only a handful of banks dominate the credit card industry. The credit card is really built on the premise that the gravy train can go on forever. At the apex of the credit bubble, and let us face it housing wasn’t the only thing being financed with easy money, credit card companies were offering zero percent offers to lure customers into debt servitude. Now that banks use the pretext that the “world has changed”, they can up those fees and interest rates and many Americans due to the weak economy are now no longer able to meet their obligations. Credit card default rates are soaring:

Source: Calculated Risk

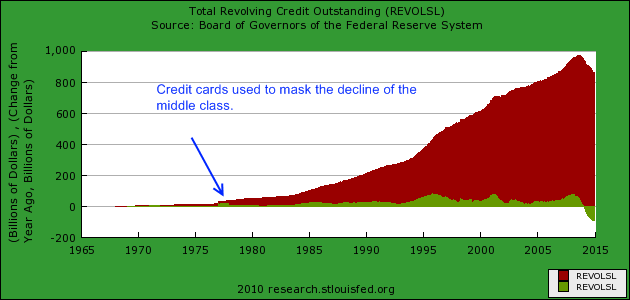

Those that can’t pay by definition will not pay and that is why we are seeing high levels of bankruptcy. A credit card was never intended to be used as a secondary source of income but that is what it has become since wages have been stagnant for over a decade. The vast majority do not pay their balance off each month. This is same misguided premise on which option ARM loans were based on. Given the option 90+ percent of the people went with the minimum payment causing an endgame that we are now dealing with. Credit card loans outstanding have been contracting at a feverish pitch:

Yet wasn’t the premise of the banking bailouts to increase credit in the market? Of course the banking system has largely captured the current lawmakers and the policy we are getting is friendly to their needs and desires while using the American taxpayer as their own form of credit card. The lie that was perpetuated was that debt equals wealth and it absolutely does not. So people in modest neighborhoods saw friends and family driving foreign cars and wondered how they were doing it with a $40,000 a year income. They were doing it by extending themselves to the point of financial disaster. So as the disaster hits, we operate in parallel universes. The public that did over extend has to realize the marketplace reaction of cutting back, losing homes, or bankruptcy. Banks on the other hand have actually come out ahead receiving trillions in dollars of taxpayer funded money. Nothing easier than getting money in a hype of fear with politicians friendly to your cause.

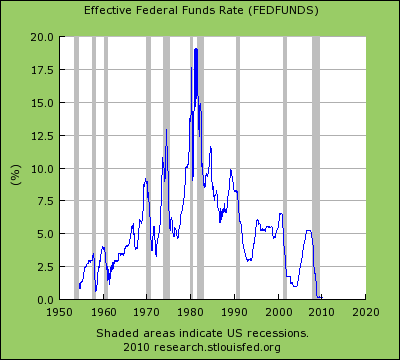

Much of the easy lending environment was given the blessing by the Federal Reserve and U.S. Treasury:

The above is really the story of the housing bubble, credit bubble, and easy money world we had for over a decade. That is now completely changed and I often wonder if people realize that we won’t be going back to how things were. We can’t. The underlying issue is the amount of debt being serviced now. GDP includes this as a “positive” but we are now transferring this additional wealth to the banking sector on merely servicing preexisting debt. This is like being happy that banks made billions of dollars in overdraft fees. How is this good for the economy or most Americans? The math is so distorted that many Americans are wondering how in a country where 20 percent are underemployed we can have a 73 percent stock market rally.

The too big to fail banks are also at the center of the credit card word:

U.S. general purpose credit card market share in 2008 based on outstandings

(Note: 2007 ranking in parentheses)

1. JPMorgan Chase – 21.22% (17.74%)

2. Bank of America – 19.25% (19.36%)

3. Citi – 12.35% (13.03%)

4. American Express – 10.19% (11.40%)

5. Capital One – 6.95% (6.95%)

6. Discover – 5.75% (5.65%)

7. Wells Fargo – 4.21% (3.07%)

8. HSBC – 3.47% (3.65%)

9. U.S. Bank – 2.14% (1.84%)

10. USAA Savings – 2.02% (2.01%)

Source: Creditcards.com

It is no accident that they are now putting the vice on average Americans while sucking in trillions of dollars in bailouts. And what is the big reform? They now provide a sheet that shows you a breakdown of how you are getting screwed in different formats! This is the idea of reform right now from the corporatacracy. Until we get solid reform credit cards will continue to operate in a loan shark environment ripping off the middle class until one day Americans will wake up and realize that there is no longer a middle class.

Let The Sun Shine In......

No comments:

Post a Comment

We post comments in English and only by followers of this blog. While anyone is free to read any of the material here, comments from self-identified, moderate to left-of-center independents are welcome to post after joining up. Others may comment by email and will occasionally be posted as well.