THE OBAMA FINANCIAL REFORMS: ROAD TO CHANGE OR PERDITION?

Stabilizing A Flawed System is Not The Same As Restructuring Or Remaking It

By Danny Schechter

Author of Plunder

A recent study cited by the Editor of the Financial Times argues that we are now in a Depression although no one wants to use the term or face the music.

Recall that it took the National Bureau of Economic Research a full year to recognize the reality of a recession that analysts at investment banks had been acknowledging for as long. Despite everything that has happened, and is continuing to occur on the economic front---a rise in unemployment claims, mounting foreclosures, and escalating bankruptcies—the sense of crisis is being downplayed to stoke confidence and encourage the belief in “green shoots” and an emerging recovery.

The Obama Express is in full motion with new announcements, proposals, and laws signed daily. Yet, something’s missing. Au Contraire, Mr. Maher, there is no lack of audacity, just a failure to recognize that cosmetic alterations do not fundamental change make. What we have is a political elite that is more Clintonesque than Rooseveltesque. (If only the Repugs were right with their fears of the Socialist menace!)

These proposals, described as “new rules for the road,” were mostly embraced by the banks, a sign they are not tough enough. The Congress will probably approve them quickly because they were “hammered out” through a process of negotiations that seems to have heard more from the industry than public interest advocates.

The Washington Post tells us:

“Time and again, lawmakers, regulators and industry lobbyists pressed their concerns behind closed doors at the White House and the Treasury Department, according to participants.

“Turf-conscious regulators opposed the idea to consolidate banking oversight agencies and took their appeal over the Treasury directly to the White House. Ultimately the administration spared all but one agency.

“A few key lawmakers argued against merging the two federal agencies that oversee the stock and commodity markets. That did not happen.

“Insurance companies fought over whether a national regulator should oversee them. The White House dropped the proposal.”

Etc. Etc. Etc, ad nuseum.

So now we have 88 pages of financial reforms as if the authors of this compromised and consensualized agenda were being paid by the word. The President is telling us that “mistakes” were made as if massive crimes, theft, fraud and unregulated greed were not involved in causing the calamity at the heart if the crash of the economy.

Bloomberg surveyed the wreckage: “Financial firms worldwide have recorded more than $1.4 trillion in writedowns and credit losses since 2007 as the U.S. housing market collapsed and the economy sank into recession.”

Billions spent to unlock credit and get banks lending again have led nowhere. The financial news service quotes Tim Backshall, chief strategist at Credit Derivatives Research LLC in Walnut Creek, California.

“It is becoming clearer that banks are not as willing to lend,” he said in an e-mailed message. “With their risk rising once again, risk premiums on non-financials must rise commensurately.”

They don’t see a recovery around the corner either, “The broad sense is we have not seen the bottom there yet,” said Bert Ely, a banking consultant in Alexandria, Virginia. “For later this year, and into next year, there are just big question marks out there.”

Question marks indeed.

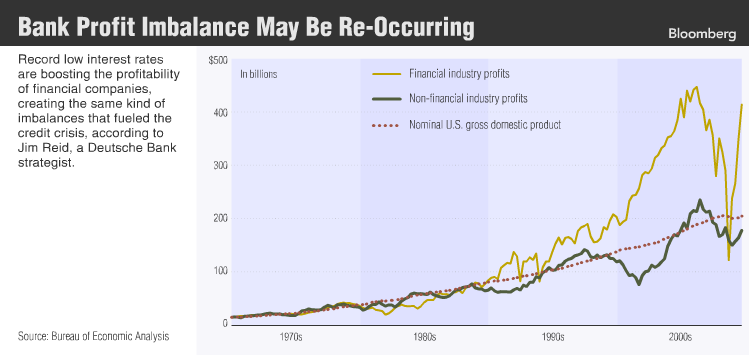

What are the questions we should be asking? What happened to changes for ratings agencies that gave high marks for bogus mortgage securities? Why trust the Fed which, in the words of one critic “started the fire” through low interest rates to extinguish it

Simon Johnson, the ex-IMF Chief now at MIT asks some others:

•Has the President really been briefed on the supposed benefits of having large financial institutions with great economic power and pervasive political influence? Don’t just claim that these are a good thing – tell us, in detail and preferably with numbers, what we the public gain from the presence of these behemoths among us. Keep in mind that “everyone has them” is no kind of argument – something so manifestly dangerous is not to be blindly copied.

•Why was executive and other compensation so notably absent from the latest Geithner-Summers joint statement of our problems and likely solutions? Does the President really expect us to believe that any set of reforms will work if they do not directly constrain the amounts that can be earned from misunderstanding risk today and hoping that the consequences do not appear on your watch? Does he have any idea of how the people who run big financial firms will game whatever controls try to limit their risk-taking?

•. Can President Obama finally talk about the much broader break down of corporate governance in this country, with boards of directors serving no discernible purpose in terms of limiting the excesses of corporate executives in the financial sector but also more broadly? Surely, without a reform package that includes measures to address this core issue, we will get exactly nowhere.”

Perhaps “exactly nowhere” is the real destination” in the sense that the real goal of the Geithner-Summers-Obama “reform” package seems to be to restore the old financial order, not restructure it, or heavens forbid, bring it under public control and accountability. New Rules and regulations are great, but do they add up to real reform?

Have the banks really acknowledged their role in the demolition derby that wrecked the economy? Not really, even as Llloyd Blankfein of Goldman Sachs admits, "We know that we have an explicit contract with our shareholders to be responsible stewards of their capital . . . we regret that we participated in the market euphoria and failed to raise a responsible voice."

Is that all they are copping to? A few weeks back. Goldman paid $60 million to Massachusetts to settle a complaint that they funded mortgages “designed to fail.” They admitted no wrong-doing, in a practice so common when Wall Street gets its fingers caught in the cookie jar of criminality.

Tell that to the millions losing their homes.

After helping to fund the subcrime market, Goldman was hailed as a visionary for turning against it. “it made $4bn profit from betting against the sub-prime mortgage market, and because - bar the fourth quarter of 2008 - it has continued to make a profit throughout.”

Clearly the profiteers are far more secure than their victims. Here are the thoughts of some knowledgeable people who want progressive change and who are in the know:

Former Investment Banker Nomi Prins: “The plan makes no mention of reconstructing the financial system.”

Marshall Auerback sees an opportunity for real reform squandered.

“As with so much of the Obama administration, great-sounding words, but nothing in the way of substantive change. Particularly disturbing are the moves on derivatives, notably “credit default swaps”. Excuse us for not liking a market that is rigged in favor of the sellers, the monopoly dealers, who even today refuse to allow open price discovery in credit default swaps among and between other dealers. True to their Wall Street ethos, Summers and Geithner have capitulated on the most important aspect of derivatives, by refusing to place these instruments on a regulated exchange, where transparency and standardization would be far more operative.

A New Way Forward: “It’s not enough to try to patch up the current system. We demand serious reform that fixes the root problems in our political and economic system: excessive influence of banks, dangerous compensation systems, and massive consolidation. And we demand that the reform happen in an open and transparent manner.”

“You go to war,” the not missed Mr. Rumsfeld once said “with the army you have.” Unfortunately in the case of Financial Reform, we are being led by Generals at the top but there are no troops or people’s army below to hold them accountable, much less push them to emulate a more aggressive approach a la FDR,

Organizing put this president in office. Only organizing can push him to do what must be done. Can we get the Congress to toughen up these uneven and timid proposals?

News Dissector Danny Schechter, blogger in chief at Medichannel.org, is making a film based on his book PLUNDER (Cosimo) news.dissector.com/plunder. Comments to Dissector@mediachannel.org